Public Ruling No. 12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land.

The Service tax is also a single-stage tax with a rate of 6.

. This DGs decision clarifies the GST treatments for Individual supplies commercial. Question then arises as to whether an individual who is not a GST registered person is required to pay GST when making a supply of his commercial property. The same as for commercial property in Singapore Malaysia has a so-called Goods and Services Tax.

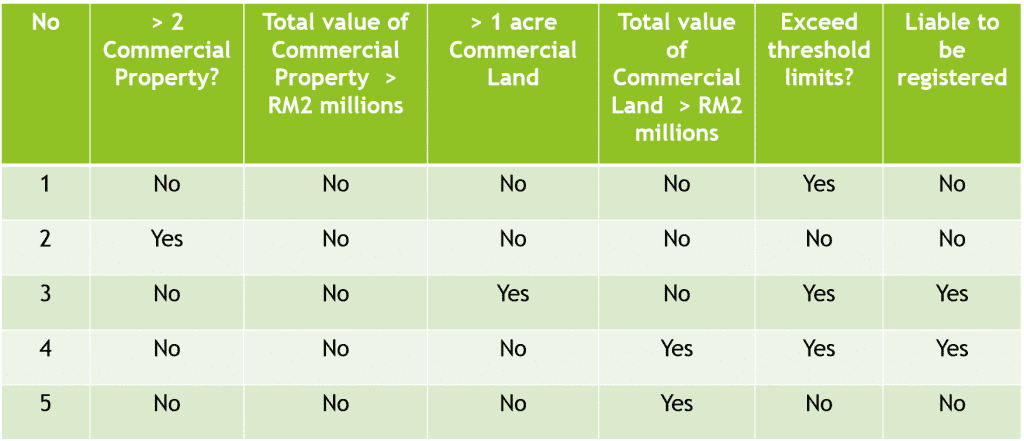

B more than one acre of commercial land. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is. A more than 2 commercial properties.

Individual supply commercial property i on any taxable supply of goods or services made in Malaysia section 9 GSTA. Individual supply commercial property i on any taxable supply of goods or services made in Malaysia section 9 GSTA. Item 1Small Office Home Office SOHO Item 2Supply of commercial.

Whether an individual has to charge GST when making a supply of. For the consumers they can identify the standard rated supplies by looking at the receipt when making the purchase. Just in case someone missed out below are the latest update on Individual Supplying Commercial Property Rent Sell DECISION BY DIRECTOR GENERAL OF ROYAL MALAYSIAN.

07052021 individual supply commercial property gst malaysia. An RM1 million commercial property unit will cost you RM60000 in GST. Normally standard rated supplies GST labelled with an S.

There are 20449 commercial properties for sale. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is. This dgs decision clarifies the gst treatments for individual supplies commercial properties ie.

Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST. The Decision 4 2014 made by. OR c commercial property or commercial land worth more than 2 million ringgit at market price.

Item 1Small Office Home Office SOHO Item 2Supply of commercial property build sell by the developer to the purchaser under an agreement for a period that.

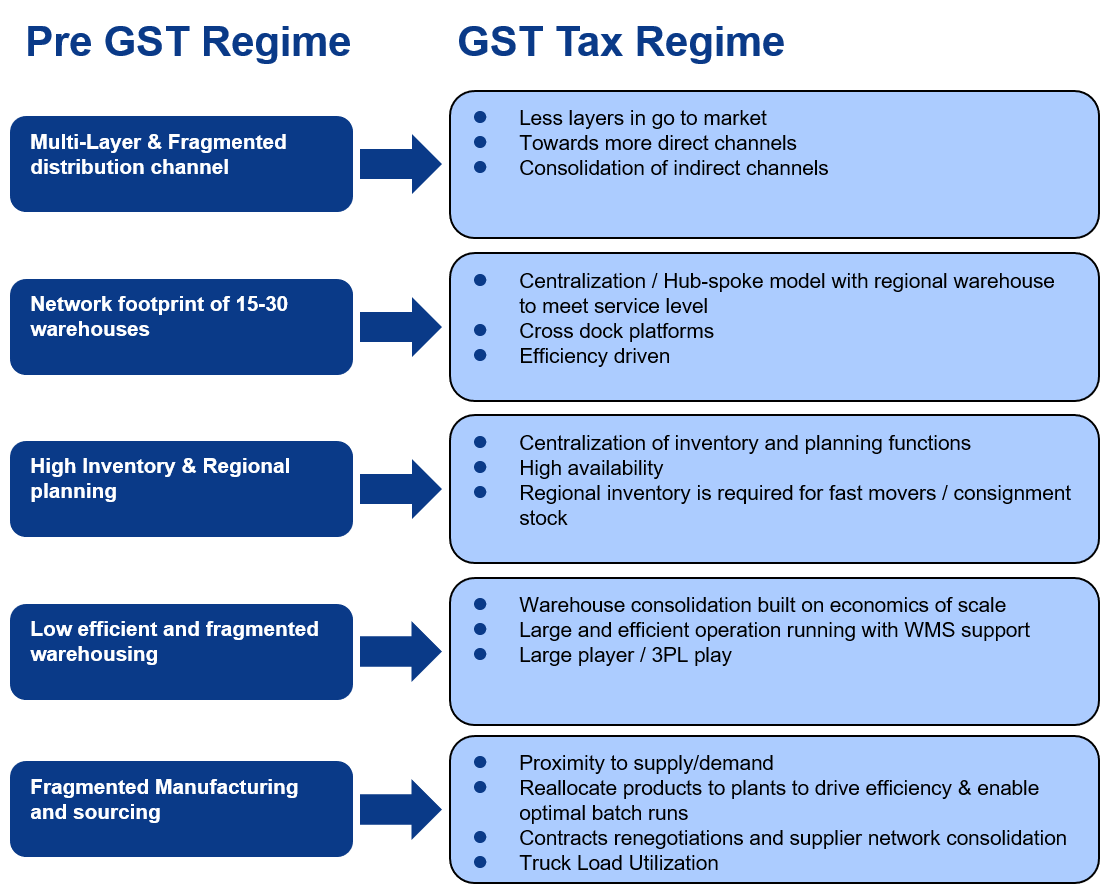

Valued Insights Asia Pacific Logistics Cbre

India S Tax Reform Its Impact To Supply Chain

Buying Commercial Property In Malaysia A Complete Guide

Buying Commercial Property In Malaysia A Complete Guide

Valued Insights Asia Pacific Logistics Cbre

Tax Planning For Investment Property 3e Accounting

What Ails The Malaysian Residential Property Sector The Edge Markets

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Real Estate New Gst Rates And Challenges

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

Valued Insights Asia Pacific Logistics Cbre

Taxation And Gst Planning For Investment Property In Malaysia

Valued Insights 2022 Asia Pacific Market Outlook Cbre

7 Differences Between Residential And Commercial Properties Propsocial

Malaysia Sst Sales And Service Tax A Complete Guide